NewsContact Us

|

TV panel prices rose in the first quarter of next year will be slightly amended2016-11-07 10:09 GOLDTECH ELECTRONICS INDUSTRIAL CO.,LIMITED

IHS Markit forecasts that LCD TV panel prices will continue to rise in the fourth quarter of 2016, reflecting supply shortfalls. As panel makers reduce production plans, notebook and LCD panel prices will also be increased accordingly.

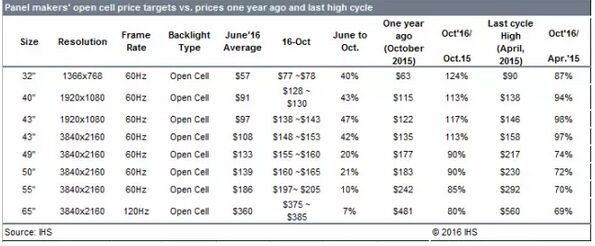

In September and October, Samsung Display, LG Display, AUO and BOE adjusted their strategies, leading to higher prices for 40-inch and 43-inch panels. 32-inch, 40-inch and 43-inch TV panel prices from June to October are 40% increase.

October 2016 prices will exceed the same period in 2015 prices. For example, 32-inch panel prices rose 27%, 40-inch and 43-inch FHD panel prices rose 20%. 49-inch, 50-inch, 55-inch and 65-inch panel prices are still lower than the same period last year.

With the capacity to expand and the market tends to mature, the overall panel showed a continuous decline in the price curve.

In the supply-demand relationship-led LCD panel cycle, when there is a shortage, the panel prices, and in the absence of market prices, prices fall. However, during the shortage period, the price will never rise above the peak of the previous wave. This is a long-term trend: with the expansion of production capacity and the market tends to mature, the overall panel showed a continuous decline in the price curve.

Similarly, the price surge in the third quarter of 2016 makes the price of the panel over the same period last year, especially 32-inch to 43-inch panel products, but the long-term trend is still to follow the LCD panel industry cycle.

IHS believes that the average size of the growth rate of television than expected, so 2017-2018 the size of the product demand has also been a corresponding increase. 2016 demand and capacity growth is very close, in the supply shortage and surplus alternately between. The first half of 2016 there was a certain degree of oversupply, but in the second half of 2016 part of the size of the TV panel will be scarce.

IHS Markit forecasts that LCD TV panel prices will continue to rise in the fourth quarter of 2016, reflecting supply shortfalls. As panel makers reduce production plans, notebook and LCD panel prices will also be increased accordingly. As the Korean panel makers gradually reduce attention on the 32-inch panel, they will increase 40-inch and 43-inch panel production. 40-inch and 43-inch LCD panel since September prices soared, the trend will continue in the fourth quarter of 2016..

In September and October, Samsung, LG Display, AUO and BOE adjusted their strategies, leading to higher prices for 40-inch and 43-inch panels. 32-inch, 40-inch and 43-inch panel prices from June to October are 40% increase, as shown in the table below.

Demand for the fourth quarter of 2016 is forecast to remain strong

September and October, panel makers continue to substantially increase the price, reflecting the supply shortage. As TV manufacturers are facing a critical moment in short supply, so panel makers in the supply chain bargaining that still occupy a more favorable position. 32-inch panel prices are still rising, but its growth rate is lower than in August.

China Taiwan and South Korea panel makers on the 40-inch, 43-inch, 49-inch and 55-inch panel and other specifications once again more than 10 to 15 US dollars. Some panel makers' 65-inch panel prices are surging as their main supply targets are major TV manufacturers, leaving few of the other manufacturers. Several TV manufacturers because of profit, has decided to cut the 2016 fourth quarter 32-inch panel needs.

As TV brand customers refused to accept the price rise, resulting in loss of profits, so a number of TV manufacturers are reducing OEM business. Overall, demand in the fourth quarter of 2016 is forecast to remain strong, but supply shortages will occur, especially in the 40-inch to 55-inch panels.

40-inch and 43-inch panel prices. As the market is tight, panel makers dominate, many TV machine manufacturers have no other choice, can only be forced to accept the price adjustment.

South Korean panel makers in the fourth quarter of 2016 panel price forecast

In addition, the following data show that the Korean panel makers in the fourth quarter of 2016 panel price forecast:

South Korean panel makers believe that, according to current demand, LCD TV panel prices in 2016 in the fourth quarter to maintain steady growth. Samsung Display expects to raise its panel prices by December.

Samsung Video Display Division needs 180-200 million panels per month, but the Samsung display company can only provide 130-150 million panels, so the supply shortage situation will continue. Samsung Display believes that other panel makers for the Samsung Video Display Division to provide the supply will also be limited.

Samsung Video Display Division uses airfreight to supply panels to its global factories, rather than shipping. Which means that the Division is currently facing a serious shortage of resources in the retail panel.

Following the peak of the third quarter of 2016, the Chinese TV manufacturers in the fourth quarter of 2016 did not significantly reduce the display company from Samsung and LG display panel procurement plan. Chinese TV manufacturers will not adjust the panel inventory in the fourth quarter of 2016, which means that the fourth quarter of 2016, the possibility of panel oversupply lower.

Samsung TV plans to ship 48 to 49 million LCD TVs in 2016, but to meet supply chain demand, the Samsung Video Display division will need to purchase about 53 to 55 million LCD TV panels. This means that the business unit in the fourth quarter of 2016 and 2017 will not stop the first quarter of procurement.

LG Display Inc. and Samsung Display Inc. remain cautious about the first quarter of 2017. Both companies believe that TV makers will eventually have to reduce demand, so as to curb rising panel prices, but it will also be reflected in the retail sector. LG Display Corp. and Samsung Display Corp. said panel prices in the first quarter of 2017 will not fall sharply as the market supply in 2017 will remain scarce as demand for all sizes grows faster than capacity growth.

Panel prices soaring, because the machine manufacturers must be in the hot season to carry out promotional activities. If there is no promotional activities, the final market demand will be significantly reduced. Therefore, the TV manufacturers must sacrifice profits. Samsung TV, LG Electronics and many Chinese TV makers have made a profit in the first half, so they can suffer a decline in profitability over time. The question is how long this time will last. Machine manufacturers may have to because panel prices soared and gradually give up sales.

As the Korean panel makers gradually reduce attention on the 32-inch panel, is likely to further improve the 40-inch and 43-inch panel prices. 40-inch and 43-inch LCD panel from September onwards a strong market price rise, and this momentum will continue in the fourth quarter of 2016. |

|

|